High-pressure cleaning machine industry: Electric motors are the largest segment, accounting for around 58% of the market.

High-Pressure Washer is a kind of equipment that uses high-pressure water to clean the surface of objects, which is widely used in civil, commercial and industrial fields. Its core value is efficient cleaning, water conservation and environmental protection, and versatility, especially in construction maintenance, automotive cleaning, and agricultural machinery cleaning. With the tightening of global environmental protection policies and the improvement of cleaning efficiency requirements, the high pressure cleaning machine market is experiencing continuous growth.

II. Supply chain structure and upstream and downstream analysis

Upstream:

Core components: High pressure pumps, motors (electric / gasoline / diesel), nozzles and piping systems.

Raw materials: steel, copper, plastics, etc. The costs are significantly affected by fluctuations in product prices.

Midway:

Core players: The top four global players (Karcher, Nilfisk, Stihl, Briggs & Stratton) account for about 32% of the market share, with medium industry concentration and fierce competition.

Regional distribution: Europe (36 percent), the United States (33 percent) and China (13 percent) are the three major production centers, with Chinese manufacturers dominating the middle and low end market with a cost advantage.

Downstream:

Civilian market: 56%, driven by household cleaning habits and DIY culture.

Commercial and industrial market: 44%, mainly used in construction, automotive services, food processing and other fields, and demand is highly related to fixed asset investment and service industry development.

III. Corporate profiles of major producers

Karcher (Germany): the world's leading high-pressure washing machine, market share of more than 15%, covering civilian to industrial products, technical advantage is high pressure pump efficiency and noise control.

Nilfisk (Denmark): commercial cleaning equipment specialist, market share of about 8%, focusing on the European and North American markets, products with durability and intelligence.

Stihl (Germany): garden tools giant, high-pressure washing machine business accounted for about 5%, relying on channel advantages to expand the household market.

IV. Policy environment and market challenges

U.S. tariff policy:

The imposition of tariffs has led to a 10% -12% increase in costs for Chinese export enterprises, a reduction in profit margins, and forced enterprises to accelerate the construction of overseas factories (e.g. Vietnam and Mexico).

Global policy trends:

Environmental regulations: The European Union's Ecodesign Directive requires that high-pressure cleaning machines increase their efficiency by 20% and promotes the upgrading of motor technology.

Regional Trade Agreements: RCEP (Regional Comprehensive Economic Partnership Agreement) lowers the barriers to market access in the Asia-Pacific region, benefiting Chinese enterprises.

V. Analysis of market status and trends

Market size and growth:

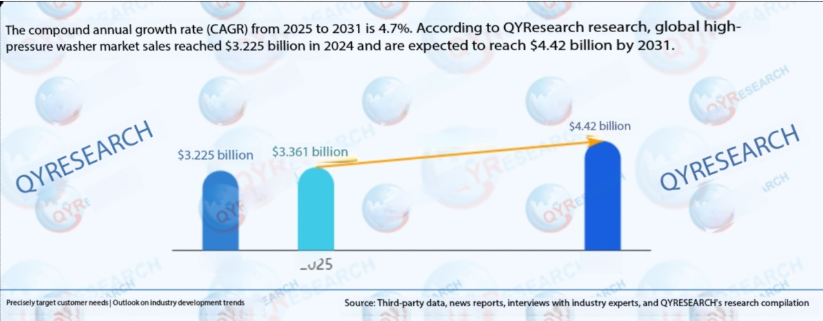

According to the latest QYResearch report, the global pressure washer market sales reached 3.225 billion USD in 2024 and is expected to grow to 4.42 billion USD in 2031, representing a CAGR of 4.7%.

Regional distribution: Europe (36 percent), the United States (33 percent) and China (13 percent) dominate the market, and Southeast Asia and the Middle East grew by more than 6 percent.

Product segment trends:

Electric motor type: accounting for 58%, benefiting from the growth of the home market and the trend of electrification.

Gasoline engine type: accounting for 30%, mainly used in industrial and remote areas, and demand is stable.

Diesel models: 12%, concentrated in large industrial scenarios with high technology thresholds.

Application area expansion:

Residential market: CAGR of 5.2% in 2024-2031, driven by increased demand for household cleaning and the popularity of e-commerce channels.

Industrial market: CAGR of 4.1%, affected by fluctuations in manufacturing investment.

In the report "Global and Chinese High Pressure Cleaners Enterprises Going Sea to Develop Business Plans and Strategies for 2025," QYResearch studies the capacity, output, sales, sales, prices and future trends of high Pressure Cleaning Machines in the global and Chinese markets. It focuses on analyzing the product characteristics, product specifications, prices, sales volume, sales revenue and market share of major producers in the global and Chinese markets. The historical data is from 2020 to 2024 and the forecast is from 2025 to 2031.